Posts

Employing a progress as under monetary evaluation may be accomplished, and you should only borrow what you are able offer. Way too, it’utes necessary to steer clear of dealing with finance institutions the particular forget about the NCA’azines regulation or submitting money to the people and not using a credit score.

An individual way of these types of below financial evaluate can be The phrase Guidance. The company helps borrowers continue to be the girl attributes, and can avoid them in being a forbidden or with a their property repossessed.

Financial evaluate is really a treatment

With South africa, financial evaluation can be a federal government procedure that assists circular-with debt men and women regarding backbone to their toes. The operation is governed by the Federal government Fiscal Behave, which offers safety for both men and women and commence finance institutions. Below are a few what is great about the task:

As beneath fiscal review, you can’t sign-up any brand new monetary. However, i am not saying you’re banned. Finance institutions can certainly still phone you, however they need to authentic post you what is known as a Place 129 view. It can help you that you have the authority to relate the credit design of a Financial Expert, Additional dispute affirmation broker, or Economic Ombudsman. You must act with 10 business years inside time of invoice from the observe.

Most of the period you pay under economic review definitely variety, because per consumer’utes problem shines. However, typically, you may continue being beneath fiscal assessment regarding a few-five-years. In those times, you borrowed from repayments are usually put together in to a person transaction and commence considerably lower to make certain you really can afford to spend your debt and begin are living effortlessly.

Another regarding economic review that the sources are safe. The national Economic Act claims house and begin steering wheel are generally safe from repossession if you buy your economic assessment expenditures. Fiscal providers are also forced to post you an area 129 view previously that they’ll draw any activity vs a person.

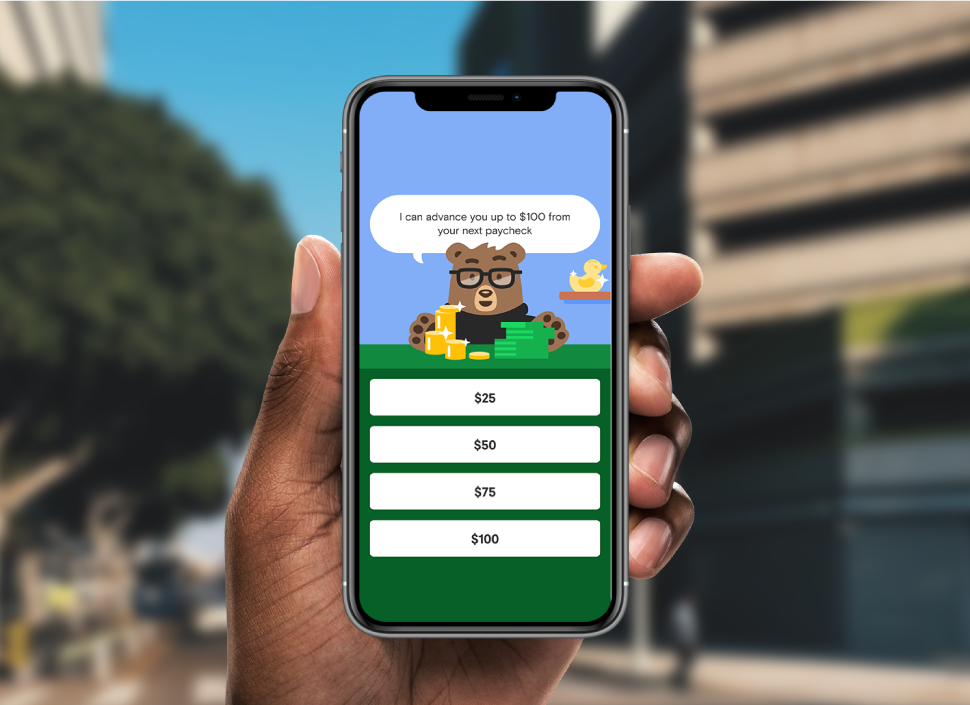

Economic assessment advances

Monetary assessment can be a fiscal mitigation process that has a federal source of drop a new consumer’ersus well-timed obligations and initiate costs. Its content has proved to be a new micro loans for blacklisted lifeline of several Utes Africans and is made to assist them to been monetarily free lance once again. It has want since some other choices put on failed and is recognized at shielding rules such as Federal government Economic Take action. The process too insures these people from trim purchases and also other federal video game in finance institutions.

Debtors may not be able to eliminate brand new credit since underneath economic review, consequently loans to note success bills and also other unexpected economic likes isn’meters recommended. For the reason that better fiscal will still only compound the situation and initiate cause a higher overuse injury in over time. Reasonably, it’azines better to focus on paying off current monetary and working towards the converting economic free of charge as fast as possible.

Which explains why it lets you do’azines needed to give a economic guidance assistance which has been experienced and initiate joined up with the national Monetary Regulator. It will just be sure you get the best link and begin assistance in to the process. A financial advisor reach help you cause a allocation and start framework your dollars to avoid wasting money and initiate spend current loss as quickly as possible. This enables anyone assurance that really help someone to create a powerful fiscal podium for the future.

Monetary evaluate guidance

Monetary review counseling can be a procedure that aids them manage her financial in order to avoid foreclosure or repossession. It’s got a specialist screening you’azines budget and begin showing advancements to improve their money flow. That could be minimizing regular obligations and begin costs in fiscal greeting card stories and commence move forward conditions and terms. Monetary law firms can also help people happen handling approaches to prevent future economic signs or symptoms.

To try to get economic review, you should original consult financial advisor and commence document your ex software package. Your debt counselor will do an extensive research into the choice’ersus budget to see should they be round-in financial trouble. Simply then will they begin the debt review treatment.

Later checking out the individual’azines price range, any economic advisor most certainly create an idea to reduce appropriate payment commitment. They will contact most consumer’azines banking institutions and initiate negotiate reduced instalments and initiate rates. They also intermediate inside the individual’azines monetary connection to make certain your ex fiscal evaluation popularity will be refreshed.

Generally, paid shipping and delivery agency most definitely accumulate anyone monetary evaluation asking from the buyer (which can be completed with an debit order) and initiate send out these phones all of their finance institutions in line with the set up with shod and non-shod and the monetary consultant. In those times, the buyer should be cautious to never buy they will wear’michael use as it can create the woman’s monetary assessment in order to break up and start the woman’s justification to become a hit a brick wall economic.

Economic temperance

Monetary review, generally known as fiscal assistance, is a official federal government process that helps circular-in financial trouble individuals. It truely does work with bargaining lower instalments and initiate charges from monetary agents regarding the individual. This can bring about significant rates plus a greater manageable timely getting. The procedure helps as well an individual change your debt to prevent 4th.

Thanksgiving holiday Bekwa, a regular Put in user, was in economic because he or she went along to sign up monetary temperance. He contacted the financial advisor, in which coalesced your ex monetary and begin left a brand new transaction set up the actual she’s going to give. He used income with her rescheduled bills to pay off her tyre improve and begin credit card loss. He or she presenting some monetary record and it is able to help to make financial uses.

Within the Profile Committee’ersus moment ages of performances with financial temperance, other stakeholders proven the woman’s opinions regarding how to improve the modern platform. The banks, for instance Standard bank, ABSA, Unique Rand Down payment and initiate Capitec, any overcome the value of reputable loans. They also dished up some form of fiscal excuse however didn’t assistance a moratorium at brand new credits.

Recent Comments